Our Mission

Why It Was Created

The Community REIT was conceived to bridge wealth access between private investors and major institutional development.

Founder Juan S. Reid envisioned a mechanism that would let small investors collectively own a share of high-yield, professionally managed assets—something historically reserved for sovereign funds and private equity.

The initiative began as a pilot concept inside our REIT’s 2022 hospitality and healthcare platform.

By 2024 it formalized into a standalone investment arm designed to:

Pool 40,000 early investors at $500 per unit;

Aggregate capital toward flagship developments; and

Convert those holdings into equity dividends backed by cash-flowing properties.

The Evolution Toward $3.7 Billion

The REIT ecosystem follows a ten-year expansion plan:

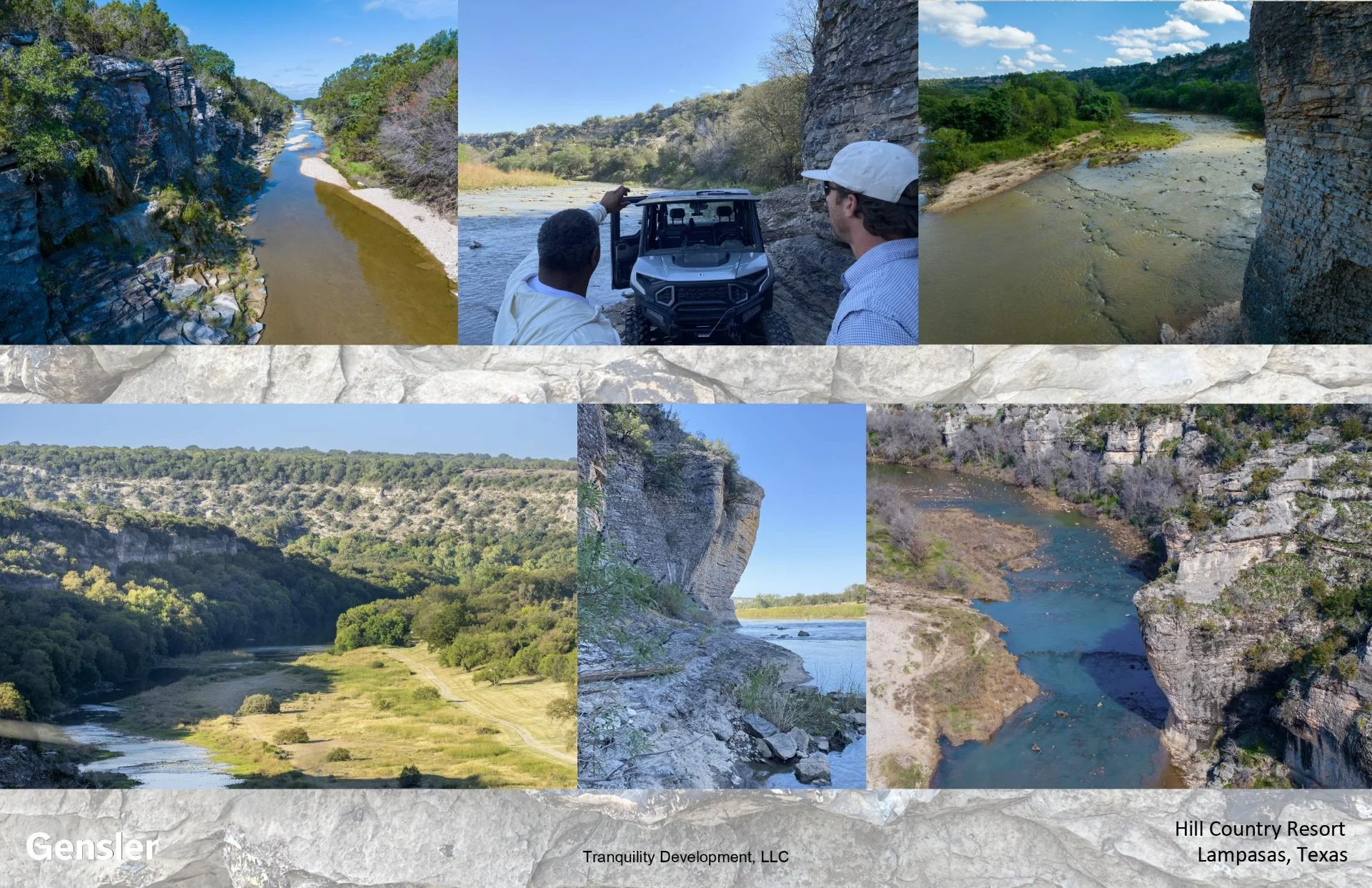

Phase I (2025 – 2026): Launch flagship Hill Country Resort ($240 M asset value).

Phase II (2026 – 2028): Acquire or build three additional hospitality assets across the U.S. South and Caribbean.

Phase III (2028 – 2032): Add healthcare and wellness properties, reaching $1.5 B in stabilized holdings.

Phase IV (2033 – 2035): Portfolio refinancing and global expansion to achieve the target valuation of $3.7 B.

Each stage compounds returns through reinvested dividends, property appreciation, and debt-to-equity optimization.

10-Year Expansion Plan and Projected Growth

Stockholder Return Model

Based on current projections and normalized REIT yields, a fully capitalized Community REIT portfolio could generate collective stockholder earnings of approximately $13.8 million during the maturity cycle. Those returns depend on property performance, market conditions, and the REIT’s reinvestment strategies.