PORTFOLIO

Projected NOI (Net Operating Income)

Lagos

Hotel NOI (75% occ., ADR $1,000): ~$55M/year

Residences Sales (avg. 80% absorption over 5 yrs): ~$550M total (~$110M/year equivalent)

NOI Range (blended): $150M – $180M/year by Year 5

Dallas

Hotel NOI (75% occ., ADR $1,500): ~$82M/year

Residences Sales (avg. 90% absorption over 5 yrs): ~$650M total (~$130M/year equivalent)

NOI Range (blended): $200M – $225M/year by Year 5

Capital Expenditure (CapEx)

Total Development Cost (Base Reference): $1.84B (from Tranquility Towers breakdown)

Lagos Adjustment: Higher logistics & import cost (+15%) → $2.12B

Dallas Adjustment: More favorable construction financing & stable supply chains (-10%) → $1.65B

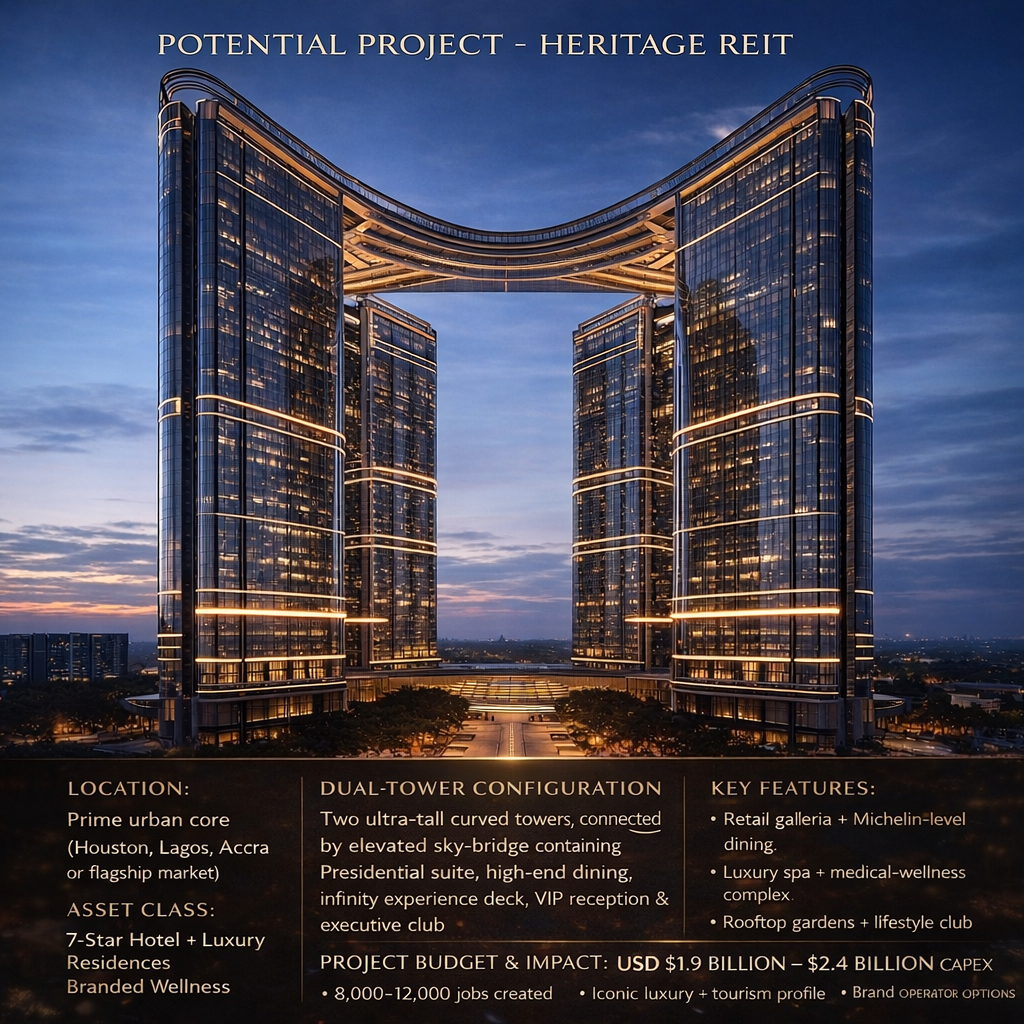

Project Overview

Concept: 7-star hospitality tower integrating hotel, branded residences, and luxury non-branded units.

Model Source: Tranquility Towers breakdown (200 hotel keys, branded residential, non-branded residential).

Target Markets:

- Lagos, Nigeria – high urbanization, oil wealth, rising middle/upper class, international business hub.

- Dallas, Texas – strong convention/tourism hub, oil & tech economy, high domestic/international traveler demand.

Important Investor Disclosures

Introductory Note:

Before investing, carefully consider the investment objectives, risks, charges, and expenses. This is not an offer to sell, nor a solicitation of an offer to buy, securities in any state where such offer or solicitation is not authorized. The following summaries are qualified in their entirety by the more detailed information in our public filings with the SEC.

1. Forward-Looking Statements

This website contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act. These statements, which involve risks and uncertainties, relate to our future operations, performance, or financial condition. Actual results may differ materially from those projected. We undertake no obligation to update these statements.

2. No Investment Recommendation

The information provided on this site does not constitute investment, tax, or legal advice. You should consult with your own professional advisors before making an investment decision.

3. SEC Registration

The Community REIT is registered with the Securities and Exchange Commission (SEC) and files annual, quarterly, and current reports (e.g., Form 10-K, 10-Q, 8-K). Registration with the SEC does not imply approval of the investment merits.

Our REIT Framework

What is a REIT?

A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs provide all investors the chance to access diversified, liquid real estate portfolios.

Our REIT Qualification

To maintain our status as a REIT and avoid corporate-level income tax, we adhere to strict IRS rules under Section 856 of the Internal Revenue Code, including:

Income Tests: At least 95% of our income must come from passive sources like rents and mortgages.

Asset Tests: At least 75% of our assets must be real estate, cash, or U.S. Treasuries.

Distribution Requirement: We must distribute at least 90% of our taxable income to shareholders annually.

Ownership Structure: We must have a minimum of 100 shareholders and cannot be closely held.

Investment Risk Factors

Investing in The Community REIT involves various risks, including the potential loss of your entire investment. This investment is suitable only for investors who can afford such a loss.

Material Risk Factors:

Real Estate Market Risk: Property values can fluctuate and may decline due to local or national economic conditions.

Interest Rate Risk: Rising interest rates can increase borrowing costs and negatively impact property valuations.

Limited Liquidity: Our shares are not listed on a national securities exchange. There is no public trading market, and our share redemption program provides limited liquidity, is subject to restrictions, and may be suspended.

Economic & Geographic Risk: A recession or downturn in the specific markets where our properties are located can reduce rental income and occupancy rates.

Regulatory Risk: Changes to laws governing REITs or real estate could adversely affect our operations and profitability.

*For a complete discussion of risks, please see the "Risk Factors" section of our most recent Form 10-K.*

Our Distribution Policy

Policy Overview

A core component of our REIT structure is the distribution of income to our shareholders. We target quarterly distributions, but these are not guaranteed and will depend on our operating results, financial condition, and other factors.

Anticipated Distribution Schedule:

Declared: Quarterly, by our Board of Directors

Record Date: Typically the last day of the quarter

Payment Date: Approximately 30 days after the record date

Tax Treatment of Distributions

REIT distributions are generally taxed as ordinary income. However, a portion may be classified as a return of capital or qualify for lower capital gains rates. Shareholders will receive an annual Form 1099-DIV detailing the tax characteristics of their distributions for the year.

We recommend consulting with a tax advisor to understand the specific implications for your situation

Understanding Share Liquidity

Important Notice Regarding Liquidity

Shares of The Community REIT are not publicly traded. There is no guarantee of a market for your shares, and you should plan to hold your investment for the long term.

Limited Redemption Program

We may offer a share redemption program as a potential, but limited, source of liquidity for shareholders. This program is subject to significant limitations and is offered at the sole discretion of our Board of Directors.

Key Program Terms:

Availability: Subject to available cash and a quarterly cap (e.g., 5% of outstanding shares).

Holding Period: A minimum holding period (e.g., one year) is required.

Redemption Fee: A fee (e.g., 2%) may apply for shares held less than a specified period.

Suspension Rights: The program may be modified or suspended at any time, particularly during adverse market conditions.

Please review our share redemption plan, available in our SEC filings, for complete details and limitations.

Governance & Conflict Management

Our Commitment to Sound Governance

We are committed to strong governance practices and transparent management. Our board includes independent directors who provide oversight of management and adherence to our policies.

Management of Potential Conflicts

Our external advisor is compensated through fees, which may create potential conflicts of interest, such as:

Fees based on the size of our asset portfolio.

Acquisition fees paid on property purchases.

Our Mitigation Strategies:

Independent Board Oversight: A majority of our board is independent.

Detailed Policies: We maintain and enforce robust conflicts of interest policies.

Third-Party Validation: We use independent third parties for property appraisals and other key valuations.